- Home

- Sven Carlsson

The Spotify Play Page 17

The Spotify Play Read online

Page 17

“It was a stealth organization,” as one source would put it.

Do It Again

Daniel Ek’s plan of attack on the billion-dollar TV industry began with proprietary technology. The twenty-nine-year-old founder handpicked two exceptional software developers—known internally as Ludde and Andoma, after their user names in the company’s chat rooms—to jump-start the effort. Ludvig “Ludde” Strigeus was the self-taught wiz kid known for single-handedly writing the front-end code for Spotify’s first music player, and was the only programmer at the company who reported directly to Daniel. His partner, Andreas “Andoma” Smas, was a coder who joined the company in 2008 and had previously worked on video streaming technology.

Their goal was to reinvent online video. In keeping with Spotify’s etiquette, the coders would not tolerate buffering; the stream could never pause to load. To assure a seamless experience, Strigeus and Smas created an entirely new file format, called Spotify Video. Abbreviated as .spv, the files carried a lighter load than the usual formats. Strigeus was meticulous and obsessed with saving computer memory wherever he could.

“Every time you waste a byte, God kills a kitten,” he would muse to his coworkers.

Despite their best efforts, the Magneto team eventually abandoned the Spotify Video format for HLS, or HTTP Live Streaming, the only format that was compatible with Apple’s iOS mobile operating system.

Daniel and his Chief Product Officer, Gustav Söderström, began the hunt for someone to lead their new foray into video. The Swedes said virtually nothing about the secretive project during interviews. Eventually, they tapped the Comcast veteran Mike Berkley for the role, and in the spring of 2012, he moved with his family from Silicon Valley to New York. He commuted to Spotify’s Chelsea offices in the former Port Authority building on Eighth Avenue. There, a few floors above Google’s New York headquarters, Daniel and Mike drew up a vision for their project.

“We are about to enter the Golden Age of Video,” as an internal pitch described it in February 2012, just before Mike formally joined Spotify.

Daniel believed he had identified a potential gap in the TV market. He wanted to build a digital, on-demand alternative to linear broadcasts via cable and satellite. He was not looking to compete directly with Netflix—whose catalogue at this time consisted mainly of old movies and past seasons of various TV series—but rather to enter the same space as Hulu. Viewers of Spotify would be served live sports and news, current seasons of TV shows, and a selection of movies. Daniel instructed the Magneto team—which was to keep its mission secret even inside Spotify itself—to tailor content for each viewer.

“Your video service will be highly personalized. It will know your tastes and interests and your consumption patterns. It will anticipate what content you want and when you want it,” the pitch stated.

By the end of 2012, Mike Berkley was able to show his bosses a prototype.

Video Killed the Radio Star

Twice a year, Spotify’s top brass gathered for the company’s Strategy Days, where between fifty and one hundred executives and key employees would debate the future direction of the company. The meetings were held in spring and fall, either in the US or in Sweden. An invitation to the power meeting was a clear status symbol among lower-ranking staff.

In late November, the Strategy Days were held in an anonymous conference room in downtown Stockholm. It was below freezing, and many participants struggled to make it there on time.

“Nothing is impossible, except everyone being here at 8am,” as one punctual attendee quipped on Twitter.

Mike Berkley, who had flown in from New York, took the stage in front of roughly sixty of his peers and told them that he saw video as an additional core business for Spotify. At this point, he and his team had spent around a year trying to create a new type of user experience.

Mike—a musician turned businessman—picked up an iPad with a 3G connection. He opened an app that not even Daniel Ek had seen yet. Suddenly the tablet started to broadcast live Swedish cable TV. Mike flicked seamlessly between channels; the shows were being transmitted live, but as soon as he tapped the screen, they restarted from the beginning. The app came with an instant playback mode. The interface was every bit as quick as Spotify’s music player.

“It was a magical experience,” as one attendee would describe the presentation.

By a feat of programming, the Magneto team had eliminated the loading time associated with digitally encoded TV. The app—eventually dubbed Spotify TV—could flip instantly between channels. For the second time in the company’s brief history, engineers had built a product far superior to anything available on the market.

It felt like the finished product, but it was highly provisional. Spotify engineers had installed five small antennas in the southeastern corner of Jarla House, as close as possible to the twin antenna towers that formed a landmark in southern Stockholm. They were able to hack into around 30 Swedish cable channels, using the open source software Tvheadend to decrypt the signals and convert them into streams destined for Mike’s iPad. Once again, a Spotify prototype had been built on pirated content. Daniel was impressed but, having grown weary of license negotiations, he wasn’t convinced. At least not yet.

“I’m not worried about the product, I’m worried about the business case,” he told people working on the project early on.

Mike and his team spent the next few years negotiating with a wide range of TV companies—from Swedish networks and cable companies to Time Warner, Fox, and CBS—to secure licenses for their content. They also drew up plans to build a digital TV receiver, Spotify’s first-ever hardware product.

Living in a Box

During the fall of 2013, a group of Spotify employees traveled to Shenzhen, the epicenter of China’s tech and hardware industry, across the border from Hong Kong. Shenzhen was home to factories that manufactured the iPhone, Dell’s laptops, and headphones for Sony.

The Spotify team was in town to find a supplier for a small receiver and remote control that could be used with the Spotify TV app. On the surface, the blueprints looked much like the Apple TV system. The team told its Chinese counterparts as little as possible about the hardware, so as to not alert competitors. Back in Stockholm, Daniel Ek was mulling over questions of industrial design.

“We want to build our own hardware,” he told Konrad Bergström, an energetic, forty-two-year-old Swedish entrepreneur with curly gray hair.

Daniel had chosen Bergström for the task because of his strong track record in hardware design. He was the co-founder of a Swedish startup called Zound Industries, which had struck gold designing headphones and speakers under its own brand, Urbanears, and by licensing the rights to the vintage audio brand, Marshall. Their colorful Urbanears headphones had already been featured in Spotify ads, forming a kind of counterpoint to the white-wired earphones that Apple had been working hard to entrench in popular culture ever since the launch of the iPod.

Spotify was already rolling out its own remote listening technology, Spotify Connect, which would let users switch seamlessly between connected speakers. The Zound co-founder, who dreamt of taking on Dr. Dre and Jimmy Iovine’s Beats Electronics, now wanted to produce multiroom speakers together with Daniel Ek. A fruitful partnership, Bergström thought, would marry hardware and software in a way that could give Apple a run for its money.

Daniel, clearly a bigger fish than Bergström in the pond of Swedish tech, asked if Zound would be interested in designing a prototype for the streaming company’s first piece of hardware. Bergström immediately accepted.

“I’ll give you a good price,” he said.

Over the coming months, engineers at Zound’s Stockholm offices drew up designs for a black Spotify-branded remote and a receiver that plugged into the electrical outlet. From there, an HDMI cable ran straight into the user’s TV to power Spotify’s video offering.

The sleek remote carried the Spotify logo, with three wavy li

nes originally intended to represent audio streaming. The remote let the viewer navigate a grid of channels: up and down for sports, drama, and news; right and left for various programs within each category. Like Spotify’s music player, the technology anticipated user behavior; as someone watched a certain program, the nearby channels would be on standby, streaming in the background at a low bandwidth. The move made switching channels as instant as on cable TV.

“It felt immediate,” as one source would put it. Konrad Bergström took a number of meetings with Daniel Ek during 2013 and 2014. Zound spent hundreds of thousands of dollars developing the prototype, yet charged considerably less for the work.

A sketch of a prototype for the hardware intended for the Spotify TV project. (Sebastian Ramn)

Torn

During 2013, Nordic TV executives were feeling the pressure. Younger viewers loved streaming TV series at their own convenience. Netflix had recently launched in Scandinavia. One appraisal showed that it had become the largest on-demand video service in Sweden within its first year. The local competitor Viaplay—which owned the rights to the national soccer league and to Spain’s La Liga—had slipped to second place. The undisputed king of Swedish tech had no trouble booking meetings with executives in the TV industry. Five years after launching its service, Spotify was a clear success in the Nordics. Nearly half of all adults in Sweden had registered a debit card with the service. Decision makers in television knew that Daniel Ek could dominate their field as well.

The Spotify CEO was ready to invest tens of millions of dollars to explore a market that was many times bigger than music. He realized that his service could not stop at Swedish cable channels: it needed a rich American offering as well. Daniel wanted CNN, Cartoon Network, Disney, and ESPN to all be available. The Magneto team held discussions with a number of the large providers in the US, from Time Warner to Fox to CBS.

Daniel was said to be eager to secure the rights to soccer matches between his two favorite teams: AIK in Stockholm and Arsenal of North London.

In 2013, he took a meeting at Jarla House with Jonas Sjögren, the CEO of Discovery Networks Sweden, owner of the local channels Kanal5 and Kanal9. He was a former colleague of Spotify’s new head of HR, Katarina Berg, who had made the introduction. Daniel began by asking a few basic questions about the TV business, and his counterpart delivered honest answers. His experience of startup companies, such as the Swedish online video venture Magine, was that they would usually try to weasel out of paying for content.

“So, we have two sources of income,” Sjögren explained, detailing how TV networks made money both from commercials and by charging their distributors. Not a single distributor could avoid paying for content simply because they were able to attract new viewers. Sjögren was trying to imply that the same went for tech companies, regardless of the strength of their platforms. If a company like Spotify was given a discount, he explained, everyone else would start to haggle on the price. TV networks would see their business models upended.

Daniel also took several meetings with the network TV4. He was spotted in their offices in the Stockholm port district of Värtahamnen and received delegations of TV4 executives at Jarla House. His counterparts were both curious and skeptical. Viasat, a major distributor owned by Cristina Stenbeck’s investment company Kinnevik, was openly resistant. Any new offering from Spotify would compete directly with their digital service, Viaplay. Skeptics in television circles saw Spotify potentially damaging the relationship between TV companies and their distributors, and worried that their brands would be diluted. If viewers start to consume a mix of content on Spotify, then channels like TV4 and Kanal5 could lose their luster. Outside the Nordic countries, television executives were even harder to persuade.

Even within Spotify, resistance to Daniel’s pet project was spreading. As details of the product began to emerge, the flaws in the business model became clear. A thin slice of cable TV content would not match the abundant feeling users got from being served a global catalogue of recorded music. Yet a full-fledged digital TV app—with live sports, drama, and cable news—would require massive investments and require consumers to pay considerably more than the initial estimate of 300 crowns, or around forty-five dollars, per month.

Money for Nothing

With time, Daniel Ek began to open up about Spotify TV, bouncing ideas off of his trusted lieutenants. In May 2013, during the company’s Strategy Days in Uppsala, a university town north of Stockholm, he spoke about broadening the company’s vision. He floated the idea that Spotify might become a hub for creativity in a wider sense, not just music. The idea was debated but never really took hold.

At the next strategy session, held that fall in New York City, Mike Berkley rolled out the vision behind Spotify TV. His team aimed to reinvent the TV industry, a vision that resonated with many of the attendees. Yet others had questions. The issue split Spotify’s top employees into two camps. On Daniel’s side were those who saw a fragmented TV market devoid of hard-hitting digital products. Neither Netflix nor HBO—which had recently acquired the local streaming offshoot HBO Nordic after a successful test run—had nailed their digital offering, they thought.

Others saw Daniel heading in the wrong direction. They believed that Spotify ought to focus on scaling up its music offering, and not risk diluting its brand by venturing into TV. Moreover, changing user behavior—from listening to viewing—was notoriously difficult. Why would a person who listens to music on Spotify be prepared to abandon their cable TV, HBO Nordic, Viaplay, or Netflix?

Some within Spotify’s executive ranks had a crass view of the project. To them, Daniel’s high-flying video ambitions showed that he was either growing tired of dealing with the record labels, or simply looking for a shiny new toy to show the company’s investors.

The Spotify TV team had been isolated, partly to shield it from internal criticism. But by early 2014, as the service began to take on its final form, doubts had spread among some of the CEO’s closest allies. By then, the team had grown to at least seventy-five full-time employees, working on anything from market research to partnership bundles with telcos. In salaries alone, the project had cost around $15 million.

A launch would require much more money than that. Three people would later recall how even a limited content package for the Nordic markets would have cost nearly $300 million to license. Payments for marketing and the hardware itself, which was to be free for the consumer, would then be added on. With live sports, the costs immediately soared beyond that figure.

“The sports totally killed the equation,” as one source would recall.

In the end, even Daniel began to waver. The margins in Spotify’s loss-making music business were troublesome enough. Either he could offer a TV product for around forty-five dollars per month, letting his investors foot much of the bill, or raise the fee substantially and risk losing potential viewers. He wasn’t especially keen on either option.

But in August 2014—three years after he had set out to disrupt the online video market—the CEO gave the project one final push. Turning once again to a Google veteran, Daniel headhunted Shiva Rajaraman, who had spent several years on the product side at YouTube. Spotify’s new Head of TV brought a handful of his former colleagues with him to Stockholm. His predecessor, Mike Berkley, left Spotify at the end of the month.

Soon, Shiva and his team had scrapped the hardware part of the project. The prototypes that had come back from China did not live up to expectations, especially the encryption standards. Tracking down a new supplier would be costly and time consuming—and time was no longer on Spotify TV’s side. Apple TV had continued to grow, and Netflix was bigger than ever. Not to mention mid-size players such as Hulu and Roku, which were coming up in the US.

But perhaps, the re-assembled team thought, there was room in the market for an app that was compatible with third-party hardware, such as Amazon’s dongle, Fire TV. Shiva got in touch with the network he had built while

working for YouTube. He sought to construct an offering that could be launched in Scandinavia and the US simultaneously. But it quickly proved difficult. The costs shot up as soon as the US market came into question. During the fall of 2014, staff were gradually siphoned off the Magento team and relocated to other parts of Spotify. By the end of the year, one key member would recall, there was hardly anyone left.

Heartbreaker

The fateful message was delivered to Konrad Bergström during a lunch meeting with one of Daniel Ek’s top lieutenants. The Zound co-founder stormed out of Farang, a swanky restaurant across the street from Spotify headquarters. The secret project he had spent months working on for little money suddenly looked like a fiasco. There would be no video-streaming hardware. And when it came to the multiroom speakers, Spotify would instead choose to deepen its partnership with the hardware firm Sonos, one of Zound’s main competitors.

In early 2015, a cargo pallet arrived at Jarla House. A thousand leftover receivers and remotes had been shipped from China by boat. There was no longer any room for them at the factory in Shenzhen.

Apple Buys Beats

TO FULFILL HIS PROMISE TO investors of large-scale success in the United States, Daniel Ek needed to offer more than a searchable music database. The blueprint he had inherited from Napster held a natural appeal to anyone who had sat by a desktop computer in the 1990s and browsed millions of music collections via online chat rooms. But Spotify’s user base skewed young, and by the early 2010s, most teens had found alternate ways to discover tracks online.

A powerful player in the United States was Pandora, a steaming service that would switch on like car radio and play songs with similar musical traits. It would become clear that Spotify needed to expand its repertoire and offer more of a lean-back experience, as product designers in Silicon Valley would describe it. This was a clear departure from Daniel’s original vision in which users were assumed to be actively searching for music, building playlists, and sharing them with others. At times, he seemed surprisingly reluctant to let that version go.

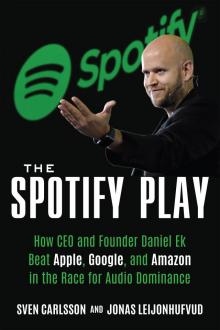

The Spotify Play

The Spotify Play